Reduce Tax With the Homestead Exemption

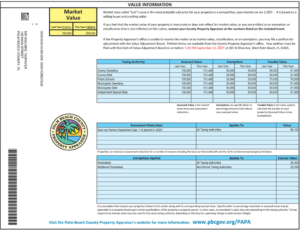

I received the following information listed below from the Palm Beach Property Appraisers office.

If you are a new permanent home owner in Palm Beach County or in the state of Florida…

OR

…if considering buying property in Florida to make this state your permanent home, skim this over.

The following will provide you with great information for you if you are considering filing for a Homestead Exemption in the state of Florida.

If you are a permanent Florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property taxes each year.

If you are a permanent Florida resident, you may be eligible for a homestead exemption, which can save you generally $750 to $1,000 in property taxes each year.

(Did you receive your pink homestead exemption receipt card in the mail? If so, no need to refile. Simply keep the card as your receipt that you have been automatically renewed for another year.)

A $25,000 exemption is applied to the first $50,000 of your property’s assessed value if your property is your permanent residence and you owned the property as of January 1. This exemption applies to all taxes, including school district taxes. An additional exemption of up to $25,000 will be applied if your property’s assessed value is between at least $50,000 and $75,000. This exemption is not applied to school district taxes. In addition, a homestead exemption limits any increase to your assessed value to a maximum of 3% each year or the amount of the change in the Consumer Price Index, whichever is lower.

Three ways to apply:

Three ways to apply:

• E File at pbcgov.org/PAPA

•Visit one of our five service centers to file in person

•Complete the application online, print it out, and mail it to our office

All homestead exemption applications must be submitted by March 1. Once you qualify, we will renew your homestead exemption annually as long as you continue to qualify for the exemption.

Visit pbcgov.org/PAPA to E File and for information on other available exemptions for seniors, families, veterans, and more.

Click here for your Amazon deals!

Click here for your Amazon deals!